Incentives (✔ Local, ✔ State, ✔ Federal)

Always check with your accountant.

The Sumter County Authority offers Pilot Bonding and various local and state incentives to create an environment conducive to business and community growth.

The Authority provides Land Management, Marketing, and Industrial Parks with Full Service Utilities and Infrastructure Development to qualified companies looking to establish new operations, expand, or relocate. Additionally, the Authority develops properties, initiates marketing programs, and provides financing packages for qualified companies. If you are interested, we are ready to discuss economic development opportunities in Sumter County!

Our Authority board actively works with existing and prospective businesses considering Sumter as a location to grow and create jobs.

Our executive director is always reachable and is proactive, with outside-the-box thinking, innovation, and creativity.

✔ Sumter County Economic Development Incentives

- Close proximity to major southeastern markets with efficient bypass routings for trucks connecting with US 19 and GA Route 49 to nearby interstate connections.

- Two fully developed industrial parks equipped with maximum allocation for electric, natural gas, water, and sewer capacity; excellent rail service is provided as well.

- Spec building available to be tailored to the needs of a business looking to locate or expand.

- Industrial & commercial property for warehousing, distribution, manufacturing, and contact center needs.

- Both taxable and non-taxable revenue bonds for qualified applicants.

- Revolving loan funds through the Joint Development Authority, River Valley Regional Commission, and City of Americus.

- Efficient, full air service at Jimmy Carter Regional Airport for corporate aircraft (6,021-foot runway with asphalt and lighting).

- Acclaimed “Quick Start” workforce training for new or expanding industry is provided by South Georgia Technical College. The John M. Pope Industrial Technology Center offers splendid facilities for business seminars, workshops, and community events. The college boasts a 99% job placement record and is one of the few institutions of its kind to offer on-campus housing.

Sumter County Economic Development Jobs Tax Credit Incentives

As a “tier-one” State of Georgia-designated county, Sumter County businesses are eligible for state job tax credits of up to $4,000 for jobs created. See Program Link: Georgia Job Tax Credit Program. This credit may offset up to 50% of a corporation's state income tax liability.

Sumter County Freeport Tax Exemption (raw materials, inventory of completed products, work in progress)

Both the City of Americus and Sumter County offer Freeport Inventory Tax Exemptions at 100% on the following classes of personal property:

- Manufacturer’s raw materials and goods-in-process inventory;

- Manufacturer’s finished goods produced in Georgia within the last 12 months and held by the original manufacturer; and

- Warehouse, distribution, or manufacturing firms with finished goods determined to be shipped outside of Georgia.

Expedited Plan Review and Permitting

Sumter County and its cities work together to ensure your project runs without delay, and the Authority is your liaison.

Revenue Bonds (General and Specific)

Revenue Bonds are available through this Authority.

Sumter Workforce Training and Development

Sumter County maintains a labor force of almost 17,000 (Inflow and County residents) in the community, and over 300,000 within commuting distance. With industrial manufacturing leading the workforce, Sumter County has a wide array of sectors. From mining to moldings and millworks, plastic and metal fabrication to contact centers and more, a wide array of sectors are represented in the community. Agriculture continues to thrive and serve as the leading local economic impactor, with dairy, cotton, peanuts, and fruits and vegetables leading the way. Average wage rates create opportunities for citizens to enjoy a comfortable lifestyle and for business and industry to find the workforce needed to meet demand. Find more information.

Sumter County HUBZone Program - Priority for Your Company When Selling to the Federal Government

'In the Zone' means Sumter businesses can gain preferential access to federal contract awards and are able to receive a 10% price evaluation preference. Get your business certified as a HUBZone vendor, an SBA program for small companies operating within certain areas of the country. Sumter County is a certified HUBZone. This means your company can receive a 10% price preference in full and open procurements. The federal government aims to award at least 3% of all federal contracting dollars to HUBZone-certified small businesses. Follow the six easy steps through the link below.

Sumter County Commercial Electric Rebates through Georgia Power

Any new or existing Georgia Power business customers can take advantage of rebates & incentives. Find money-saving offers for your business.

Wi-Fi-Enabled Thermostat, Grocery Display Case LED Lighting, Night Covers for Display Case, High-Efficiency Servers, New Construction Lighting, Grocery Case Door Gaskets, Business EV Charger Plus Rebate, Grocery Anti-Sweat Control, Strip Curtains, Variable-Speed Irrigation Pump, Evaporator Fan Motors on Refrigerated Walk-Ins, Variable Frequency Drives…

✔ State of Georgia Incentives and Taxes

The State of Georgia offers a wide array of incentives to support private-sector growth. Frequently named the “Top State for Doing Business,” the state partners its incentives and resources with local communities to develop the perfect partnerships for growth. Sumter County is designated a State of Georgia “Tier-One” County, which offers a state job tax credit of up to $4,000 for jobs created in various sectors. The Development Authority is ready to assist you in securing State of Georgia resources and incentives.

Taxes - Single Factor Apportionment

The Georgia corporate income tax single-factor apportionment formula means that only a company's Georgia gross receipts (sales) are used to determine the portion of its income subject to Georgia's corporate income tax. Georgia became the first state in the Southeast to adopt a “Single Factor Gross Receipts” apportionment formula. This apportionment formula treats a company’s gross receipts (or sales) in Georgia as the only relevant factor in determining the portion of that company’s income subject to Georgia’s six percent corporate income tax. Georgia is one of only 13 states exclusively using Single Factor Apportionment. Most states still use a traditional apportionment formula in which a company’s in-state property and payroll factor into the calculation of a company’s corporate income tax.

Single-Factor Apportionment significantly reduces the effective rate of Georgia income taxation for companies with substantial sales to customers outside Georgia. In addition, Georgia does not use the so-called “Throw Back Rule,” which many states use to tax income from sales of goods or services to out-of-state customers if the customer’s state does not already tax that income.

Film Incentives

Sumter County has received its Camera Ready designation from the Georgia Department of Economic Development. This means we are trained to work with production companies to provide one-on-one local assistance. In addition, we know the perfect location for your shoot and can provide assistance and insight on film permits, lodging, and more.

In July 2020, Business Facilities Magazine ranked Georgia as the No.1 state for motion picture and TV production.

Television and film companies may receive a tax credit of up to 30% of the money spent on production and post-production. Minimum spending is $500,000.

Under the Georgia Entertainment Industry Investment Act, Georgia provides a 20% tax credit, with the State covering the remaining 10%. Little or no tax liability for your company? Transfer your tax credits.

According to Broderick Johnson, producer of The Blind Side, through the Georgia Department of Economic Development, “…Georgia’s tax break is one of the best, if not the best in the country.”

For more information about the credit and forms, CLICK HERE.

To read all about the Credit and find your contact, CLICK HERE.

ALWAYS CHECK WITH YOUR ACCOUNTANT.

✔ Federal Incentives

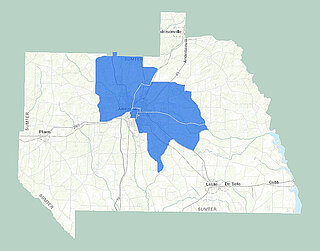

Federal Opportunity Zone

The Federal Opportunity Zone is an Investment Credit Program within defined areas of Sumter County. It allows investors to defer the capital gains of other investments into new projects within certain ‘Sumter County Zone’ designations. The program was designed as an economic tool to spur growth by providing tax benefits.

An investor can defer tax on gains:

- Until the date on which the Qualified Opportunity Fund is sold or exchanged, or through December 31, 2026

- Five years - 10% exclusion of the deferred gain

- Seven years - 15% exclusion of the deferred gain

- Ten years - eligibility for an increase in the basis of the investment to its fair market value

- Property may be transferred rather than cash as an investment to the Qualified Opportunity Zone, but may be only partially eligible for tax benefits.

We greatly appreciate qualifying for the Federal Opportunity Zone and consider it a great economic incentive.

To become certified as a Qualified Opportunity Fund, an eligible corporation must complete Form 8996 and file it on time.

If additional assistance is needed, please contact our office, your accountant, or the Department of the Treasury. You may find more information and guidance:

Federal Opportunity Zones – FAQs

ALWAYS CHECK WITH YOUR ACCOUNTANT.

Your accountant may find more information and guidance under IRC 1400Z-2 and by viewing the instructions on IRS Form 8949.